The 3-Minute Rule for Mileagewise - Reconstructing Mileage Logs

The 3-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Blog Article

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

Table of ContentsThe Best Guide To Mileagewise - Reconstructing Mileage LogsThe Of Mileagewise - Reconstructing Mileage LogsThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking AboutAll About Mileagewise - Reconstructing Mileage LogsNot known Facts About Mileagewise - Reconstructing Mileage Logs10 Simple Techniques For Mileagewise - Reconstructing Mileage LogsHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Timeero's Fastest Range function recommends the shortest driving path to your staff members' location. This feature enhances productivity and adds to cost financial savings, making it a vital property for businesses with a mobile workforce.Such a strategy to reporting and conformity streamlines the typically intricate task of taking care of gas mileage expenditures. There are several advantages related to utilizing Timeero to track gas mileage. Let's have a look at a few of the application's most significant attributes. With a relied on mileage tracking device, like Timeero there is no demand to fret about accidentally omitting a date or piece of details on timesheets when tax obligation time comes.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

These additional confirmation procedures will keep the IRS from having a factor to object your gas mileage documents. With accurate mileage monitoring modern technology, your workers do not have to make rough mileage price quotes or even fret regarding mileage expenditure monitoring.

For instance, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all automobile costs. You will need to continue tracking gas mileage for work also if you're making use of the actual expenditure approach. Keeping mileage records is the only way to separate company and individual miles and supply the evidence to the IRS

Many gas mileage trackers allow you log your journeys by hand while determining the range and reimbursement quantities for you. Many likewise come with real-time journey monitoring - you require to begin the app at the begin of your trip and stop it when you reach your final destination. These applications log your start and end addresses, and time stamps, along with the complete distance and repayment quantity.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Among the questions that The IRS states that car expenses can be considered as an "regular and required" expense in the training course of working. This includes expenses such as fuel, upkeep, insurance policy, and the car's devaluation. For these costs to be thought about deductible, the lorry should be utilized for company objectives.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

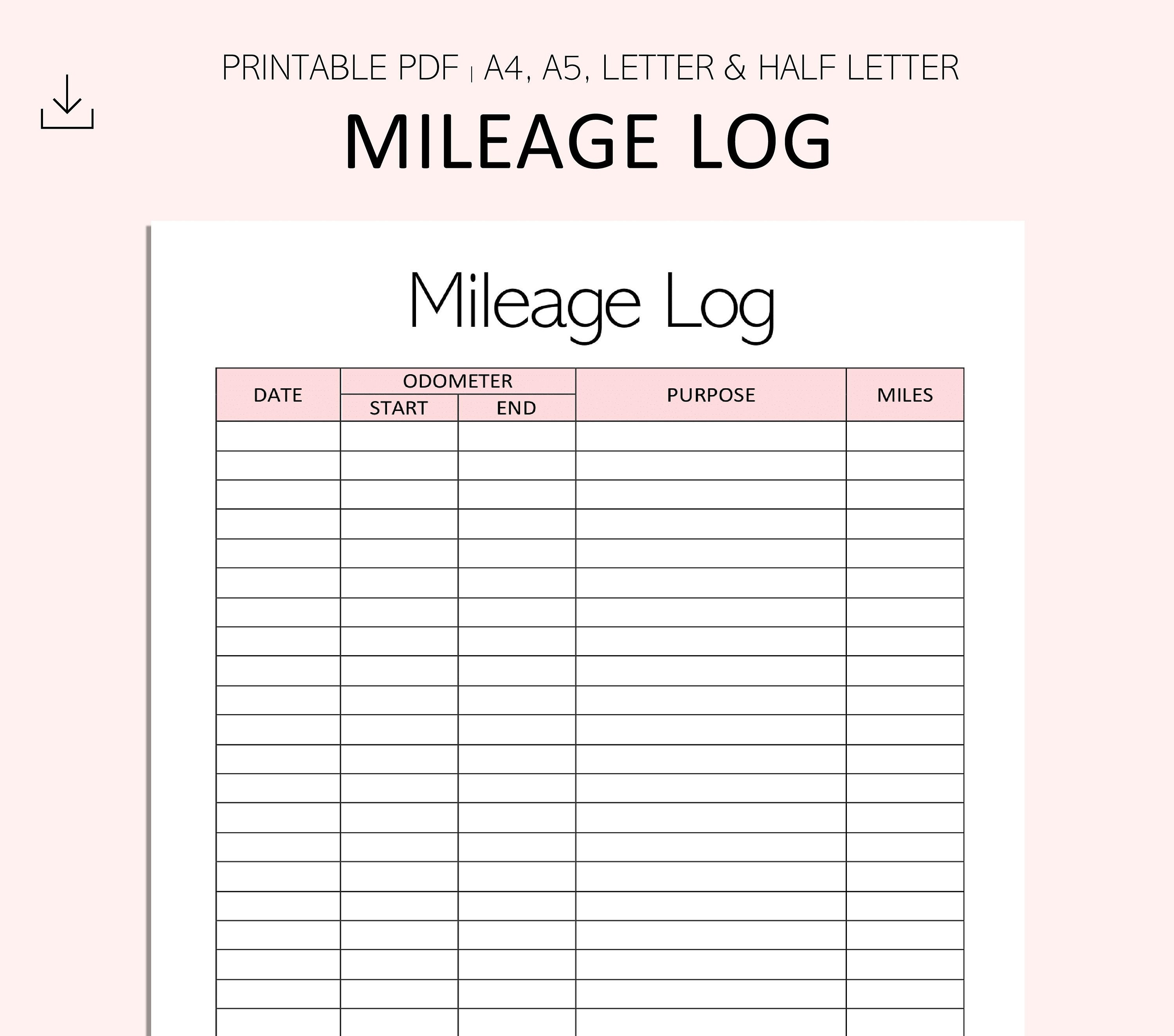

Beginning by taping your car's odometer reading on January first and afterwards once more at the end of the year. In in between, vigilantly track all your company trips taking down the beginning and ending analyses. For each and every trip, record the area and organization function. This can be streamlined by keeping a driving log in your cars and truck.

This includes the overall organization gas mileage and total mileage build-up for the year (business + personal), journey's day, location, and purpose. It's vital to videotape tasks immediately and keep a coexisting driving log describing day, miles driven, and company objective. Right here's just how you can enhance record-keeping for audit functions: Begin with making sure a careful gas mileage log for all business-related traveling.

The Only Guide for Mileagewise - Reconstructing Mileage Logs

The actual expenses technique is a different to the conventional gas mileage rate technique. Rather than computing your deduction based useful reference upon an established rate per mile, the actual costs approach allows you to subtract the actual costs associated with utilizing your automobile for organization purposes - free mileage tracker. These costs consist of fuel, maintenance, repairs, insurance, depreciation, and various other associated costs

Those with substantial vehicle-related expenditures or distinct conditions may profit from the actual costs technique. Eventually, your selected approach should align with your specific monetary goals and tax circumstance.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

(https://www.anyflip.com/homepage/zgufb#About)Whenever you utilize your vehicle for business trips, videotape the miles took a trip. At the end of the year, once again write the odometer analysis. Determine your total business miles by utilizing your begin and end odometer analyses, and your taped business miles. Accurately tracking your specific mileage for business trips aids in corroborating your tax reduction, specifically if you opt for the Requirement Gas mileage technique.

Keeping track of your gas mileage manually can need diligence, but keep in mind, it might save you money on your tax obligations. Tape-record the complete gas mileage driven.

Mileagewise - Reconstructing Mileage Logs for Beginners

In the 1980s, the airline market ended up being the very first commercial customers of general practitioner. By the 2000s, the shipping industry had actually taken on general practitioners to track bundles. And now virtually every person utilizes GPS to obtain about. That suggests virtually everyone can be tracked as they set about their company. And there's snag.

Report this page